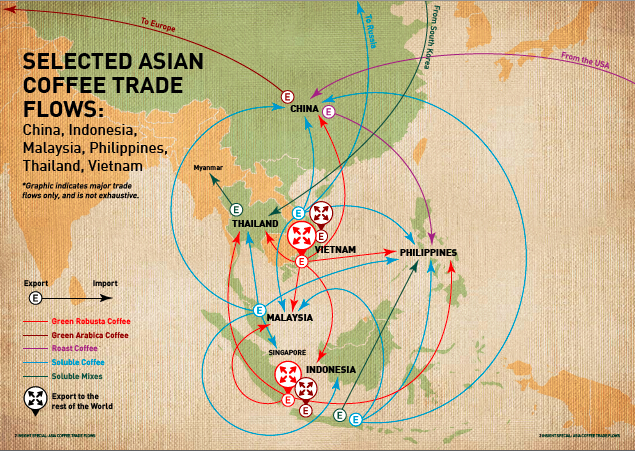

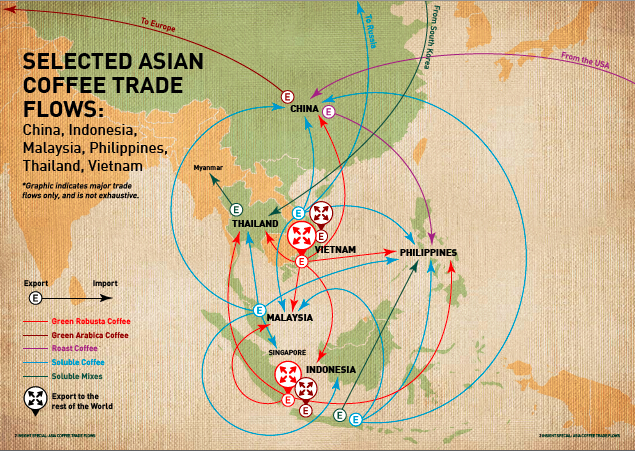

Coffee At Your Side - NSIGHT SPECIAL: ASIA COFFEE TRADE FLOWS

In the 20th century, coffee trade flows were a one way street. Green coffee flowed from origin to the consuming countries of North America, Europe and Japan. Some origin countries, like India and Brazil, built up a soluble manufacturing base, but this value-added coffee still flowed in the same way – from origin to the consuming countries.

Fast forward to the 21st century, and the rise of Asia.

Coffee trade flows have got a lot more complicated. The new consuming markets of South East Asia are all coffee producers, but there is a huge and growing trade of different types of green coffee, soluble coffee, and coffee mixes between these neighbours.

CHINA

In 2012/13, China produced over 1 mio bags of almost entirely arabica coffee. It exported the majority of it in green form, mostly to Europe, while some was consumed internally. It also imported 0.9 mio bags of green coffee, 90% of which was robusta coffee from Vietnam and Indonesia. Chinese domestic consumption is mostly in soluble form, so this robusta is being converted to soluble coffee within the country.

Furthermore, China imported around 0.2 mio bags green bean equivalent of value-added coffee, ie roasted, soluble or mixes. The roast imports were mostly from the USA, and the soluble imports were mostly from Malaysia, Indonesia and South Korea.

China then exported around the same volume green bean equivalent of value- added coffee, but this time in the most part to Hong Kong.

So, the Chinese coffee trade flow is strangely balanced, with a similar volume of green exports of arabica flowing out and green imports of robusta flowing in. Value-added coffee imports and exports are also balanced in terms of volume, but with more roast coffee coming in and more soluble coffee going out.

INDONESIA

The third-largest coffee-producing country has been steadily expanding its soluble manufacturing capacity in recent years, for both domestic consumption and for export.

Indonesia produced 12 mio bags of coffee in 12/13. Domestic consumption was just over a third of that total, and growing strongly. In 11/12, Indonesia had a very low robusta crop, and imports of green Vietnamese robusta were ramped up to 0.8 mio bags. However once the Indonesian robusta crop recovered, green imports dwindled. It is a matter of price and availability of coffee for the soluble factories which feed both the domestic and export market.

Regarding volumes of soluble exports, Indonesia has been increasing its soluble exports year on year. It exports mainly to the Philippines. These soluble exports exceed 75,000 tonnes (NOT green bean equivalent). There is some confusion with the export codes under which soluble exports are reported from Indonesia. There was a big change in reporting in 2012. Going by reporting codes in the destination countries of Indonesia soluble coffee, we estimate that around half of Indonesia’s soluble exports are pure soluble, and just under half are soluble mixes. This would mean that the green bean equivalent of Indonesian soluble exports is currently around 1.5 mio bags, but it could be less.Indonesia also imports pure soluble at a steady rate of 0.3 mio bags green bean equivalent, mostly from Malaysia and Brazil, and a negligible volume of soluble mixes.

VIETNAM

The biggest robusta producer in the world is the top supplier of green robusta for Asia’s soluble factories. Vietnam currently produces between 25 and 29 mio bags of robusta per year, plus around 1 mio bags of arabica. It has a domestic market of 1.8 mio bags and growing. Vietnamese coffee consumers are unusual in South East Asia in that they consume a good proportion of their coffee as roast and ground, as well as instant coffee. The Vietnamese coffee trade is old school – a traditional one way export trade, rather than both imports and exports that we see in other Asian producing countries. Recently, soluble manufacturing capacity has been built up strongly for both the domestic market and for export. Soluble exports from Vietnam were 0.5 mio bags green bean equivalent in 2013, but the rate of soluble shipments is up by more than 35% so far in 2014.

PHILIPPINES

Robusta production in the country is a lowly 0.5 mio bags, but the consumption growth rate is one of the fastest in the region. The Philippines does not do much coffee exporting, instead it imports about half a million bags of green robusta from Vietnam and Indonesia, and around 1.5 mio bags green bean equivalent of soluble coffee from Indonesia and other South East Asian countries. This soluble coffee is then prepared into mixes inside the country. Imports also exist under the soluble mixes codes.

Malaysian coffee production is only around 0.3 mio bags. It imports 1.5 mio bags of green coffee from Vietnam and Indonesia. It also imports around 0.4 mio bags green bean equivalent of value-added coffees, from a whole variety of countries including Indonesia, Brazil, Vietnam, South Korea and India, and exports 1.1 mio bags green bean equivalent of value-added coffees, mostly to Singapore, Thailand and the Philippines.

THAILAND

It produces 0.9 mio bags of robusta coffee, and imports 0.6 mio bags of green coffee from, again, Vietnam and Indonesia. Domestic consumption is approaching 1.5 mio bags. Thailand also imports pure soluble coffee from South Korea and Malaysia, and re-exports it as soluble mixes mostly to Myanmar, according to their trade data.

Follow us on WeChat: ALUOKE

关注我们的公众微信: 阿罗科咖啡